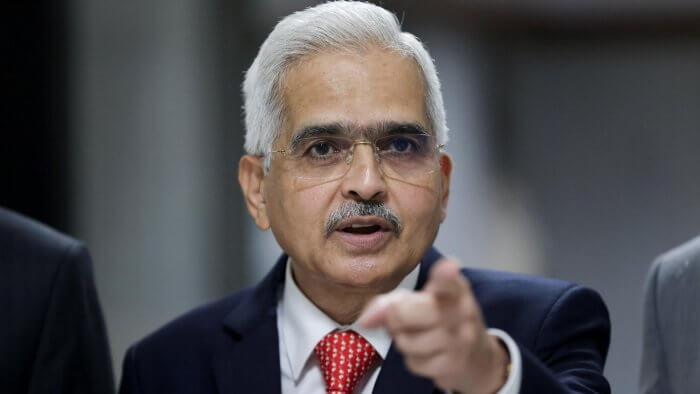

Nagpur: In order to combat rising inflation, the Reserve Bank of India (RBI) raised the repo rate by 50 basis points to 4.90 percent on Wednesday, Governor Shaktikanta Das announced. The Indian economy remained resilient, according to the central bank, as it unveiled the third monetary policy for the current fiscal year.

Governor Das stated in his monetary policy statement, “The war in Europe is lingering, and we are facing new challenges every day, which is exacerbating the existing supply chain disruption.” As a result, food, energy, and commodity prices are still high. Countries around the world are experiencing decadal-high inflation and persistent demand-supply imbalances. Inflation has become globalized as a result of the war.

Furthermore, he stated, “With no end to the war in sight and upside inflation risks, prudent monetary policy measures would ensure that the second-round effects of supply-side shocks on the economy are contained, long-term inflation expectations remain firmly anchored, and inflation gradually aligns close to the target.”

Key highlights from RBI Governor Shaktikanta Das’ speech:

- GDP growth forecast for FY23 retained at 7.2 percent. GDP growth forecast at 16.2 percent for April-June. GDP growth forecast at 6.2 percent for July-September. GDP growth forecast at 4.1 percent for October-December. GDP growth is forecasted at 4.0 percent for January-March 2023.

- The CPI inflation forecast for FY23 has been raised from 5.7 percent to 6.7 percent. The RBI’s inflation forecast is based on a normal monsoon and a crude basket price of $105 per barrel.

- The rates on the Standing Deposit Facility and the Marginal Standing Facility were raised by 50 basis points. The standing deposit facility rate has increased to 4.65 percent, and the marginal standing facility rate has increased to 5.15 percent.

The following are key points that require little explanation:

Forex reserves

India’s exports have performed admirably. As of June 3, 2022, India’s forex reserves stood at $601.1 billion: Shaktikanta Das, Governor of the RBI

Credit cards will be linked to UPI

According to the RBI Governor, credit cards, beginning with RuPay credit cards, can now be linked to UPI (Unified Payments Interface) platforms. This facility would be made available once the necessary system development has been completed.

E-mandate hike on cards

The Reserve Bank of India today announced an increase in the limit for recurring e-mandates/standing instructions on cards and Prepaid Payment Instruments (PPIs) to Rs 15,000, up from 5,000 currently.

The following is the effect of rate hikes

The impact of the RBI’s rate hike on MSMEs

“The RBI’s repo rate hike was imminent due to the spike in inflation and global macroeconomic scenarios.” The RBI has increased the cost of funds by 1% overall. The recent weather patterns will have an impact on the overall feasibility of large projects, infrastructure, and long-term projects. MSMEs, on the other hand, are rebounding as a result of improved customer sentiment following nearly two years of uncertainty. MSMEs require more adequacy and certainty of funds versus costs alone, and thus we believe they should be able to handle this increase in the medium term,” said Manish Lunia, Co-Founder of Flexiloans.com.

The impact of the RBI’s rate hike on real estate

“We appreciate the apex body’s decision to raise overall repo rates by another 50 basis points.” This will aid in containing inflation and smoothing economic growth. Inflationary pressures can weaken an otherwise robust real estate market. Already, raw material prices are rising, and an unbridled rate of inflation will drive input costs even higher, resulting in cost overruns for the developer community. In this case, they will have no choice but to pass the cost on to the homebuyers. Meanwhile, the government should make concerted efforts to reduce price increases in raw materials such as cement, bricks, steel, and so on. This will also provide some relief to the industry “RPS Group Partner Suren Goyal stated “