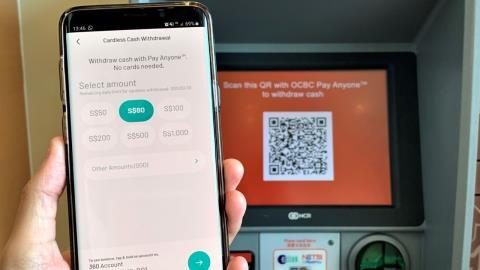

Introduction – A cold battle is underway which is indirectly connected to your wallets i.e. your debit and credit cards. Visa and Mastercard are upset with the rise of RuPay cards in Indian markets.

But before this, let’s understand how a transaction works

How it works – Visa, Mastercard and RuPay works as an interconnected link between two banks, after the authorisation confirmation is given by a customer’s bank for the payment, card association then enables the transaction between the sellers and customer’s bank accounts.

A Small amount of commission is also given to these card associations. Card associations are also called as payment gateways

Rise of RuPay – To reduce the dependency on foreign companies for card based transactions, RBI requested the Indian Bank Association to form a Non-profit company, after many years of planning, National Payments Corporation of India was handed over the responsibility to establish a card association, and then the name suggested for the payment gateway was called as RuPay i.e. Ru stands for Rupee and Pay stands for Payments. RuPay was launched on 26th March, 2012. Because of RuPay, only the minimum possession amount is given to the card association.

Support from the Government – Prime Minister’s Jan Dhan Yojna and some fascinating features of RuPay card have played a crucial role to boost the growth of RuPay card. According to the data, provided by the RBI, RuPay has captured more than 60% of the Indian Market in 2020.

Some Statistics –

June 2017 – 375 million transactions by RuPay

May 2018 – 112.7 crore transactions by RuPay

June 2019 – 1 billion transactions by RuPay

By this, we can understand why Visa and Mastercard issued a complaint to their respective Governments against the rise of RuPay.

Setbacks – RuPay has created a dominance in the Indian market only in debit Cards. Credit card market is still under the dominance of Visa and Mastercard.

Vision – RuPay aims to create a sway in debit, credit, international, prepaid and contactless cards to fulfill RBI’s vision to offer domestic payment gateways.