Nagpur: The Reserve Bank of India announced on Wednesday that it had raised the key repo rate by 40 basis points (bps) to 4.40 percent in response to rising inflationary pressures in the economy.

On May 2-4, the RBI’s monetary policy committee (MPC) held an off-cycle meeting. With around six members unanimously voting for a rate hike while remaining accommodative.

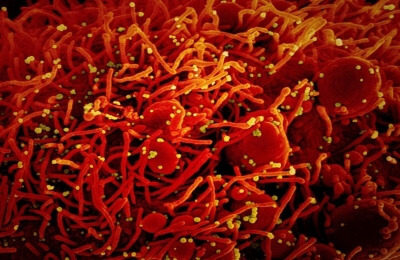

The RBI last altered the policy rate on May 22, 2020, during an off-policy cycle to boost demand by cutting interest rates to a historic low in the aftermath of the Covid-19 pandemic.

While the repo rate, or the rate at which the RBI lends to commercial banks, was raised by 40 basis points, the Governor made no mention of the reverse repo rate. As a result, it will remain at 3.35 percent.

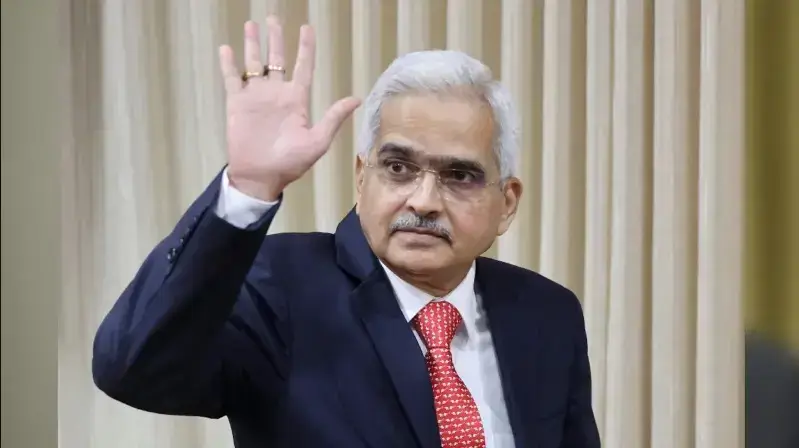

RBI Governor Shaktikanta Das annoucned the rate hike decision virtually.

Now for the question! Will your EMIs be raised?

This repo rate is used by banks to obtain funds from the RBI. When the RBI raises the policy rate, banks find it more difficult to obtain funds from the central bank. As a result, they are forced to raise their lending rates as well. As a result, a rise in the repo rate by the RBI frequently coincides with a rise in the interest rate on bank loans.

The RBI has also increased the cash reserve ratio (CRR) by 50 basis points (bps) to 4.5 percent, effective May 21. The increase in the CRR is likely to put additional pressure on interest rates. The CRR is the percentage of a bank’s total deposit that the RBI requires it to keep